Financial Management Courses After 12th: Choosing the right career path after completing high school is crucial for a successful future. If you have an interest in finance and want to pursue a career in financial management, it is essential to acquire the necessary knowledge and skills. Thankfully, there are several financial management courses available for students after 12th that can pave the way to a rewarding career in the finance industry. In this article, we will explore the top 10 financial management courses you can consider after completing your 12th grade.

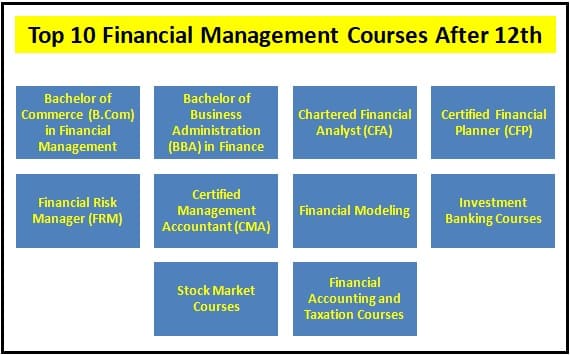

Top 10 Financial Management Courses after 12th

- Bachelor of Commerce (B.Com) in Financial Management

- Bachelor of Business Administration (BBA) in Finance

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Financial Risk Manager (FRM)

- Certified Management Accountant (CMA)

- Financial Modeling

- Investment Banking Courses

- Stock Market Courses

- Financial Accounting and Taxation Courses

Financial Management Courses After 12th

Lets explore these above Financial Management Courses After 12th with a brief for better understanding.

Bachelor of Commerce (B.Com) in Financial Management:

One of the most popular choices among students is pursuing a B.Com degree in Financial Management. This undergraduate program provides a comprehensive understanding of financial concepts, accounting principles, investment strategies, and financial planning.

Bachelor of Business Administration (BBA) in Finance:

A BBA degree in Finance offers a comprehensive curriculum that covers various aspects of finance, including financial analysis, risk management, investment planning, and banking operations. This course equips students with the necessary skills to succeed in the finance industry.

Chartered Financial Analyst (CFA):

The Chartered Financial Analyst (CFA) program is a globally recognized certification that focuses on investment management and financial analysis. It covers a wide range of topics, including ethics, portfolio management, corporate finance, and quantitative methods. The CFA designation is highly respected and can open doors to lucrative job opportunities in the finance industry.

Certified Financial Planner (CFP):

If you are interested in financial planning and advisory services, becoming a Certified Financial Planner (CFP) can be an excellent choice. This certification equips you with the skills to assist individuals and businesses in managing their finances, retirement planning, tax planning, and investment strategies.

Financial Risk Manager (FRM):

For those interested in risk management, pursuing the Financial Risk Manager (FRM) certification is highly recommended. This course focuses on understanding and managing various types of financial risks, such as credit risk, market risk, and operational risk.

Certified Management Accountant (CMA):

The Certified Management Accountant (CMA) program is designed for individuals interested in management accounting and financial management roles. This certification equips you with the skills necessary to make strategic financial decisions, analyze financial statements, and manage budgets.

Financial Modeling:

Financial modeling is a specialized skill highly valued in the finance industry. Various institutes offer financial modeling courses that teach you how to build financial models, analyze data, and make informed financial projections. Mastering financial modeling can open doors to lucrative job opportunities in investment banking, private equity, and corporate finance.

Investment Banking Courses:

If you aspire to work in the investment banking sector, several institutes offer specialized courses in investment banking. These courses cover topics such as mergers and acquisitions, corporate valuation, financial analysis, and capital market operations.

Stock Market Courses:

The stock market offers vast opportunities for individuals interested in finance. Several institutes and online platforms provide courses on stock market trading, technical analysis, fundamental analysis, and equity research. These courses can equip you with the skills necessary to navigate the stock market and make informed investment decisions.

Financial Accounting and Taxation Courses:

Proficiency in financial accounting and taxation is essential for various finance-related careers. Several institutes offer courses on financial accounting, tax laws, auditing, and compliance. These courses can provide you with a strong foundation in accounting principles and tax regulations.

Financial Management Courses After 12th Conclusion:

In conclusion, choosing a financial management course after 12th can set you on the path to a successful career in finance. Whether you opt for a degree program like B.Com or BBA in Financial Management or pursue specialized certifications like CFA or CFP, each course offers unique opportunities to enhance your knowledge and skills in financial management. Consider your career goals, interests, and aptitudes to select the course that aligns best with your aspirations.

Additionally, it is essential to research and consider the reputation and accreditation of the institutes offering these courses. Keep in mind that continuous learning and staying updated with industry trends are vital in the dynamic field of finance. By choosing one of these top 10 financial management courses, you will be well-equipped to embark on a successful and fulfilling career in the finance industry.

Hope you liked this article on Top 10 Financial Management Courses After 12th and it helped you selection of courses after 12th commerce.

Tags: Top 10 Financial Management Courses After 12th, Financial Management Courses After 12th

0 Comments